The Republic of India has the most populous democracy in the world, with a population of 133.92 crores (1.33 Billon). It could be a blessing in disguise when India can do wonders if cryptocurrency becomes more prominent than ever. However, RBI’s clamped down on cryptocurrencies, especially Bitcoin, where people have had invested millions. The banks are not allowed to deal with any transaction that is related to crypto; henceforth, people are exchanging currencies to fill their pockets with money as banks are not supporting the decentralized currency!

How can Cryptocurrency help India?

– Time is Money: Apart from its decentralized form, deals can be done quickly and efficiently.

– Privacy has always been an issue: Thus, the hindsight after the revolution of Bitcoin ensures autonomous transactions; now identities are encapsulated in the form of bits and hashes (pun intended). You don’t need a bank to verify your details and make payments accordingly!

– 24/7 Banking Facility: You don’t need a bank to make hefty transactions with limitations or taxation. India is a developing nation, and we have switched from paper money to digitalization. Where Unified Payments Interface (UPI) are making our daily deals easy. If a quick scan can save our time, then imagine what Bitcoin or other cryptocurrencies could do?

What can Cryptocurrency do in India?

– Generate a better Investment Opportunity!

A businessman who is rendering his services or offering quality products is making a good income, yet dares to pull his sleeves and invest? Or Too afraid to lose a dime when it comes to Bank Savings and charges?

In this emerging and innovative generation, people are looking for ways to save money either in the form of investment or buying something and selling at a higher price. Likewise, cryptocurrencies can do both. Isn’t that great? A substantial investment in Bitcoin would give more profits if compared with Banking Schemes!

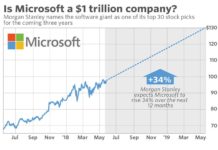

The following chart is self-explanatory when it comes to price speculation and future profits. The Bitcoin Market Capitalization is way far exceeding the population of India, and thus the Bitcoin future becomes evident.

Buying or selling a property might be still in trend, but this can change the future and can far exceed human limitations.

– Quick Hefty Transactions

British bank HSBC has executed India’s first monetary exchange utilizing blockchain for an arrangement including a fare by Reliance Industries to an American client. The blockchain-empowered letter of credit exchange was for a shipment from the Mukesh Ambani-led company to US-based Tricon Energy and decreased the time required to process the records. This is something which is not new but astonishing, as Reliance did its first ever transaction via Blockchain in minutes with no or less paperwork. The Cryptocurrency can help surge the country and somehow help the nation to go from “Developing” to “Developed.”

Since RBI has now put a restriction on banks to not to deal with Cryptocurrency, this diktat has urged the cryptocurrency fan base to move or think out of the box without hindering the exchange. That’s how people are now using P2P Exchange services to buy Tether (USDT) and get it exchanged for other currencies or cash it out. Since Tether is a stable currency and the money can be transferred from person-to-person without any bank involvement. So far, WazirX seems to be helping users, as they offer P2P exchange with their quick buy/sell support using USDT and offer diligence. You can simply signup on WazirX by clicking the following link – Join WazirX and start trading your Bitcoin or any other currency which you have been holding for a while.

Lastly, things could work out in a nation like India, but the government needs to consider the simple fact of “QUICK TRANSACTIONS.” Until then, Welp!